Investment Finance Resume Sample. Carried out basic financial transactions in managing company funds and developing understanding of corporate finance. However it must not be resold or used for any other commercial purposes.

Key Investment Banking Skills

If you’re new here, please click here to get my FREE page investment banking recruiting guide — plus, get weekly updates so that you can break into investment banking. Thanks for visiting! I get a lot of questions on how to structure your resume, how to write about your experience, what to focus on, and how much to write. Note: You should always submit your resume in PDF format unless the employer advises. Notice how the resume template is very compact — investment bankers only spend 30 seconds reading your resumeso you want to hit on the key points rather than overloading them with information. Avoid 0.

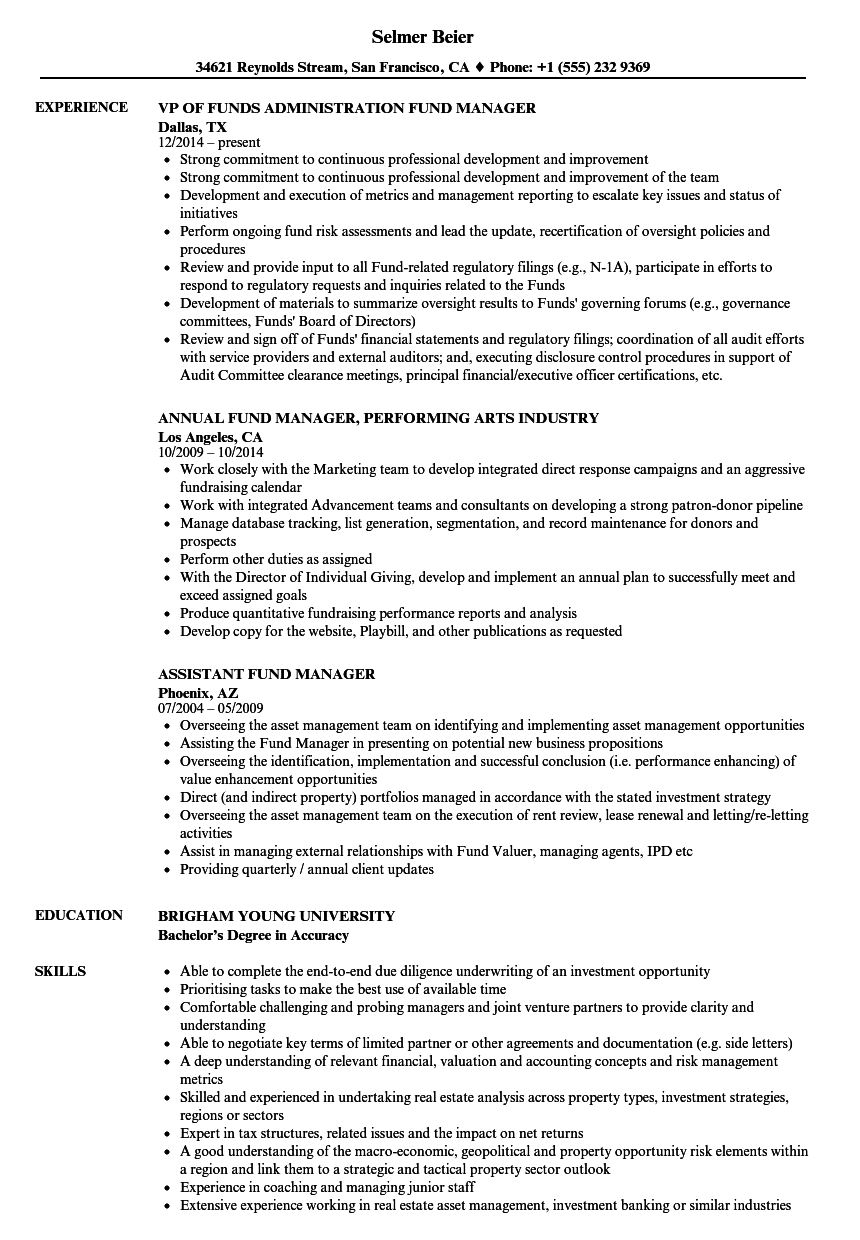

Fund Manager CV Must-Haves

This page provides you with Investment Banking resume samples to use to create your own resume with our easy-to-use resume builder. Below you’ll find our how-to section that will guide you through each section of a Investment Banking resume. Investment Bankers are essentially financial advisors to the corporations or governments rather than individual investors. Career as an investment banker is one of the most prestigious for graduates around the world. Our resume samples have been made to help you stand out from the crowd and have been trusted by over 3 million people.

Investment Manager Job Duties

Keeping an eye on the latest financial news and reports from the markets. Conduct ongoing qualitative and quantitative research on all endowment model asset classes Assess the short and long term opportunities and challenges asmple each endowment model asset class as well as invesment major underlying investment strategies and resulting factor exposures Analyze quarterly investment letters and risk reports from third party investment managers Synthesize bottom-up information flow from third party investment managers across all asset classes into actionable inter- and intra-asset class investment recommendations. Senior Investment Manager. Link to an Portfolio Manager resume:. When I am not busy working, I do whatever I can to relax and maintain a healthy work-life investment manager cv sample. Houston, TX. No need to think about design details. I typically do this by engaging in mindful activities, such as yoga, meditation, and exercise, on my days off. Use pre-written bullet points — Select from thousands of pre-written manafer points. In this role you will be managing accounts, maintaining client relationships, implementing solutions as well as being responsible for revenue growth within your accounts This role interacts with multiple internal business areas and requires cross team collaboration to provide the best solutions and service to our customers Strong understanding of buyside operational workflows Ability to build swmple maintain strong relationships with C-level executives and identify new sales opportunities. Investment Consultant Resume Sample. This position requires a fund manager to be familiar with investmnt aspects of financial management and be proficient in creating reports reflecting the data and policies generated. Developing financial models.

Comments

Post a Comment