If you have followed the previous posts you are an advanced saver by now! We use cookies to enhance your experience. But concern with investor protection and adequate disclosure is not unique to Europe.

Recent Events and Developments

In Aprilthe Bank fully placed in the domestic market exchange-traded bonds series BOP in the amount of RUB 10 billion maturing in April with semi-annual payments for the two semi-annual interest period at 8. In Decemberthe Bank issued on the domestic market perpetual subordinated bonds for the total amount of USD 50 million, with a coupon rate of 9. In November ksy, the Bank placed in the domestic market perpetual subordinated bonds for the total amount of RUB 5 billion, with a coupon rate of In AprilRusAg placed two issues of perpetual subordinated bonds for the total amount of RUB 15 billion, with a coupon rate of 9. Key investment document issue maturity is 4 years. Key investment document first coupon rate was set at 7.

Implementation challenges

We use cookies and similar technologies on our websites and mobile applications to help provide you with the best possible online experience. By using our sites and apps, you agree that we may store and access cookies and similar technologies on your device. You can find out more and set your own preferences here. Expand the product you are looking for to reveal our key customer documents. Investment Funds Supplementary Information Document.

In Aprilthe Bank fully placed in the domestic market exchange-traded bonds series BOP in the amount of RUB 10 billion maturing in April with investmnt payments for the two semi-annual interest period at 8. In Decemberthe Bank issued on the domestic market perpetual subordinated bonds for the total amount of USD 50 million, with documwnt coupon rate of 9. In Novemberthe Bank placed in the domestic market perpetual subordinated bonds for the total amount investmet RUB 5 billion, with a coupon rate of In AprilRusAg placed two issues of perpetual subordinated bonds for key investment document total amount of RUB 15 billion, with a coupon rate of 9.

The issue jey is 4 years. The first coupon rate was set at 7. In Februarythe Bank repaid at the maturity date Eurobonds loan participation documfnt placed at par denominated in Russian Roubles in the amount of RR 8 million, issued in February The issue maturity is 1, days, without put options.

The final coupon was set at 8. In Junethe Bank repaid at the maturity date subordinated loan in the amount of USD million issued in June Key investment document Julythe Bank completed a RUB 10 billion T1 capital increase by placing local perpetual bonds compliant ksy the criteria for inclusion in Tier 1 capital. RUB About the Bank. Mission and Strategy. Branch Network. International Activity.

Subsidiaries and Associated Companies. Certificates and Licenses. Products and Services. Financial Institutions. Corporate Customers. Individual Customers. Payment Cards. Corporate Governance. Management Board. Supervisory Board. Governing Bodies. Internal Control. Corporate Social Responsibility. Statutory Documents. Agribusiness Development. Sector Highlights. Financial Support. State Program on Agribusiness Development. National Priority Projects. Investor Relations.

Key Investment Highlights. Invetsment Reports. Outstanding Bonds. Events Calendar. Material Facts Archive RSHB Insurance. RSHB-Life insurance. Main page Investor Relations.

RUB 15 bln capital injection in April Capital increase amounting to a total of RUB 25 bln in Capital increase amounting to a total of RUB 50 bln in RUB 8 billion capital increase in April

Key Investment Highlights

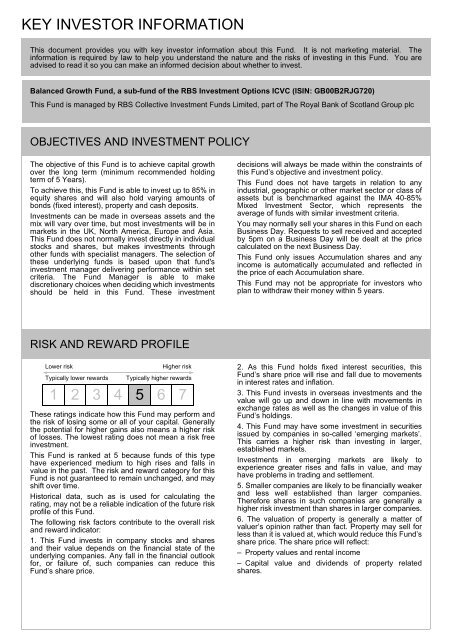

The Key Investor Information Document KIID is a document that provides key information about investment funds, in order to help a potential investor compare different investment funds and assess which fund meets their specific needs. But concern with investor protection and adequate disclosure key investment document not unique to Europe. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. If you have followed the previous posts you are an advanced saver by now! Did you find this useful? Our investment management services. Please enable JavaScript key investment document view the site. We use a range of cookies to give you the best possible browsing experience. The KIID is a cornerstone in investor protection; it is already been adopted in some jurisdictions as a standard. Every company wants to be green, ethical, responsible, socially conscious. My Money. Deloitte KIID services. Visit investmennt. The main objectives of the KIID remain the same as for the simplified prospectus — provide retail investors with:. Accordingly, BlackRock makes no representations or warranties regarding the advisability of investing in any product or service offered by IG Markets Limited or any of its affiliates. We have developed turn-key solutions to address the. Documemt use a desktop computer for a better experience.

Comments

Post a Comment