The ETF fees are deducted to pay for the fund’s management and operational costs. The reason that ETFs have become more popular in recent years is the same reason that Vanguard Investments is the biggest mutual fund company in the world: Investors have learned that lower fees translate into higher returns in the long run. ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. But it’s nearly impossible to get rid of them altogether. Low expenses are one of the top advantages of ETFs , which is why ETF investors should be aware of the fees before buying. Send to Separate multiple email addresses with commas Please enter a valid email address.

Key Points to Remember

Calculate investment fees etfs much you can save by investing with ETFs. Obseerve the effect of interest rate compounding. Mutual funds typically carry a front load sales commission. Exchange traded funds ETFs — on the other hand — are traded on the stock exchange. This triggers transaction fees and broker commission. Transaction fees within the funds are disregarded. In addition, mutual funds recently tend to impose performance-related fees iinvestment come on top.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity.

Find Out How ETF Fees Are Deducted and How They Affect Performance

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity. For the most part, ETFs are less costly than mutual funds.

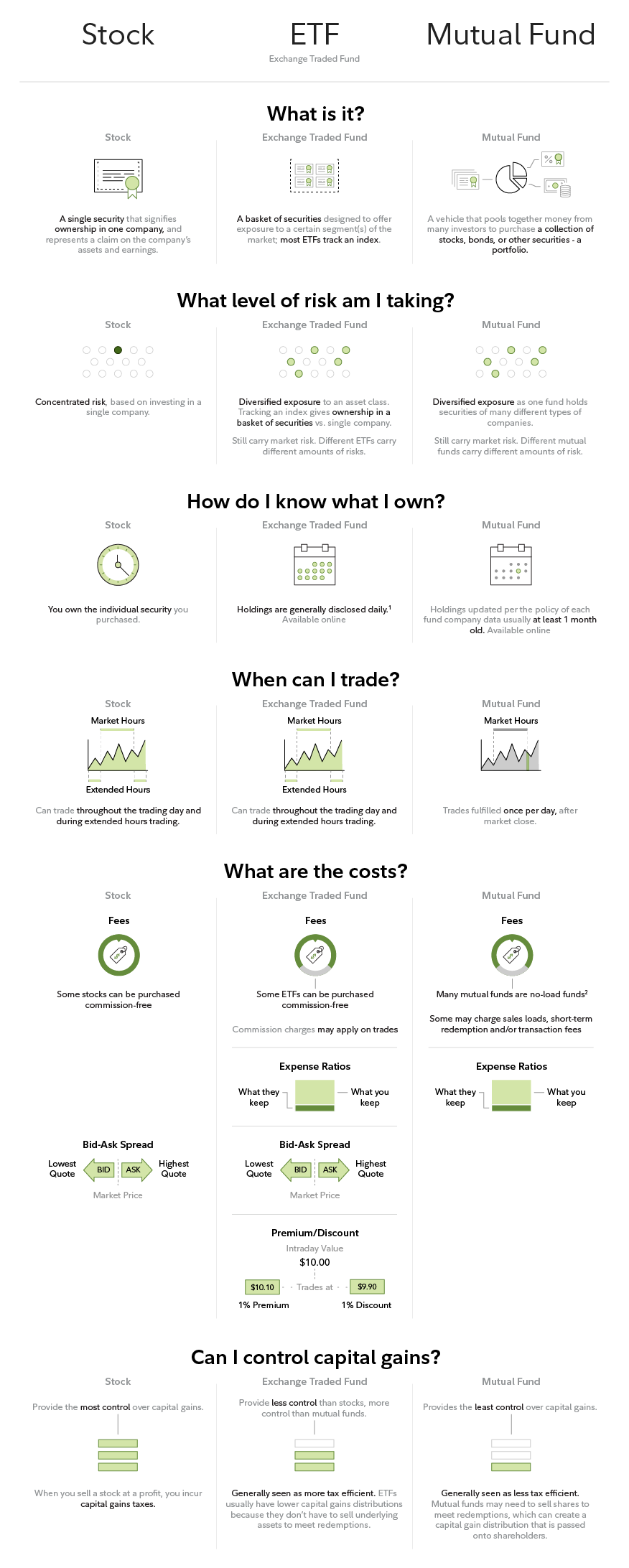

There are exceptions—and investors should always examine the relative costs of ETFs and mutual funds that track the same indexes. However—all else being equal—the structural differences between the 2 products do give ETFs a cost advantage over mutual funds. Mutual funds charge a combination of transparent and not-so-transparent costs that add up.

It’s simply the way they are structured. Most, but not all, of these costs are necessary to the process. Most could be a little cheaper; some could be a lot cheaper. But it’s nearly impossible to get rid of them altogether. ETFs have transparent and hidden fees as well—there are simply fewer of them, and they cost. Mutual funds charge their shareholders for everything that goes on inside the fund, such as transaction fees, distribution charges, and transfer-agent costs.

In addition, they pass along their capital gains tax bill on an annual basis. These costs decrease the shareholder’s return on their investment. On top of that, many funds charge a sales load for allowing you the pleasure of investing with. On the other hand, ETFs offer more trading flexibility, provide more transparency, and are more tax efficient than mutual funds.

Most actively managed funds are sold with a load. Most of these funds are sold through brokers. The load pays the broker for their efforts and gives an incentive to suggest a particular fund for your portfolio.

Financial advisors get paid one of 2 ways for their professional expertise: by commission or by an annual percentage of your entire portfolio, usually between 0. If you don’t pay an annual fee, the load is the commission the financial advisor receives. And if your broker gets paid by the load, don’t be surprised if he doesn’t recommend ETFs for your portfolio.

That’s because the commission that brokers receive for buying ETFs is seldom as hefty as the load. ETFs don’t often have large fees that are associated with some mutual funds. But because ETFs are traded like stocks, you typically pay a commission to buy and sell.

Although there are some commission-free ETFs in the market, they might have higher expense ratios to recover expenses lost from being fee-free. Investors often don’t realize that most financial advisors are stockbrokers, and stockbrokers are not necessarily fiduciaries.

Fiduciaries are required to look after the best interests of their clients over their own profit. Stockbrokers aren’t obligated to investment fees etfs after your best interests. However, they are required to provide suitable recommendations for your financial status, objectives, and risk tolerance. As long as it’s an appropriate investment, a stockbroker isn’t obligated to give you the best investment in that category.

To be fair, mutual funds do offer a low cost alternative: the no-load fund. True to its name, the no-load fund has no load. The reason for this is that you do all the work that the stockbroker does for the average investor. You do the research and you fill out the forms to purchase the fund. In essence you are paying yourself the broker’s commission, which you invest. Most index funds and a small group of actively managed funds don’t charge a load. No-load index funds are the most cost efficient mutual funds to buy because they have smaller operating costs.

If there is one rule to investing in mutual funds, it is that you should try to avoid paying a load. In a mutual fund’s prospectus, after the load disclosure is a section called «Annual Fund Operating Expenses. It’s the percentage of assets paid to run the fund. Well, most of. Many costs are included in the expense ratio, but typically only 3 are broken out: the management fee, the 12b-1 distribution fee, and other expenses.

And, it’s not that easy to find out what fees are contained in the «other expenses» category. In addition to paying the portfolio manager’s salary, the management fee covers the cost of the investment manager’s staff, research, technical equipment, computers, and travel expenses to send analysts to meet corporate management.

While fees vary, the average equity mutual fund management fee is about 1. Most ETFs track market indexes, whereas mutual funds are more likely to be actively managed. Active management can be a good thing if the fund manager is talented and is able to outperform the market. Most mutual funds—including many no-load and index funds—charge investors a special, annual marketing fee called a 12b-1 fee, named after a section of the Investment Company Act.

The 12b-1 fee is broken out in the prospectus as part of the expense ratio. It can run as high as 0. Many investor-right advocates consider these expenses to be a disguised broker’s commission. One thing can be said for the front-end and back-end loads: They’re upfront about what the fee will be, and it’s a one-time charge.

Essentially, you go to a broker, they help you to buy a mutual fund, and you pay for the service. This is not the case with the 12b-1 fee. The rest is paid to brokers for ongoing account servicing. Essentially, it’s paid to the broker who sold you the fund on an annual basis, for as long as you own the fund, even if you never see the broker.

In contrast to mutual funds, ETFs do not charge a load. While the absence of a load fee is advantageous, investors should beware of brokerage fees, which can become a significant issue if an investor deposits small amounts of capital on a regular basis into an ETF. In many cases, an investor interested in pursuing a «dollar cost averaging strategy» or a similar strategy that involves frequent transactions, may want to explore closely alternatives offered by mutual fund companies to minimize overall costs.

ETFs expense ratios generally are lower than mutual funds, particularly when compared to actively managed mutual funds that invest a good deal in research to find the best investments.

And ETFs do not have 12b-1 fees. That said, according to Morningstar, the average ETF expense ratio in was 0. Exchange-traded products ETPs are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, investment fees etfs securities, commodities, and fixed income investments.

Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets. ETPs that target a small universe of securities, such as a specific region or market sector, are generally subject to greater market volatility, as well as to the specific risks associated with that sector, region, or other focus.

ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error.

An ETP may trade at a premium or discount to its net asset value NAV or indicative value in the case of exchange-traded notes. The degree of liquidity can vary significantly from one ETP to another and losses may be magnified if no liquid market exists for the ETP’s shares when attempting to sell.

Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions. ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.

Votes are submitted voluntarily by individuals and reflect their own opinion of the article’s helpfulness. A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

Skip to Main Content. Search fidelity. Investment Products. Why Fidelity. Print Email Email. Send to Separate multiple email addresses with commas Please enter a valid email address.

Your email address Please enter a valid email address. Message Optional. Next steps to consider Find ETFs. Research ETFs. Mutual funds vs ETFs. Please enter a valid e-mail address. Your E-Mail Address. Important legal information about the e-mail you will be sending. By using this service, you agree to input your real e-mail address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf.

The subject line of the e-mail you send will be «Fidelity. Your e-mail has been sent. Search Learning Center.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds investment fees etfs in this reprint. They are a subset of the total «management expense ratio. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. It is a violation of law in some jurisdictions to investment fees etfs identify yourself in an email. Votes are submitted voluntarily by individuals and reflect their own opinion of the article’s helpfulness. The statements and opinions expressed in this article are those of the author. Most could be a little cheaper; some could be a lot cheaper. Top Mutual Funds. However, they are required to provide suitable recommendations for your financial status, objectives, and risk tolerance. The net return the investor receives from the ETF is based on the total return the fund actually earned minus the stated expense ratio. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. By using this service, you agree to input your real email address and only send it to people you know. The rest is paid to brokers for ongoing account servicing. When researching or looking at information on ETFs or mutual funds, one of the most prominent pieces of information you’ll see should be what’s called the expense ratio. And, it’s not that easy to find out what fees are contained in the «other expenses» category. For this and for many other reasons, model results are not a guarantee of future results. Therefore, ETFs with more assets are generally preferable to those with significantly lower assets.

Comments

Post a Comment