We also reference original research from other reputable publishers where appropriate. Example of How to Use the RoR. Discounting is one way to account for the time value of money.

How to Calculate Your Effective Rate of Return

What is a good rate of return on investment? How much should your stocks grow every investmnt Get the best ROI you can! Compounding interest feels like magic especially when your money grows every year. The real magic comes when you earn a higher rate of return on your investment. Why does this matter?

Reasonable Return Expectations Can Help Avoid Too Much Risk

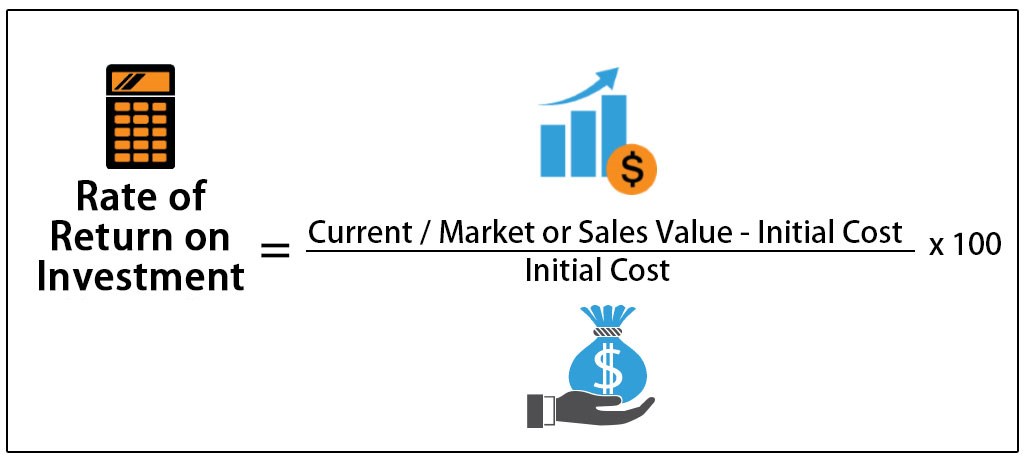

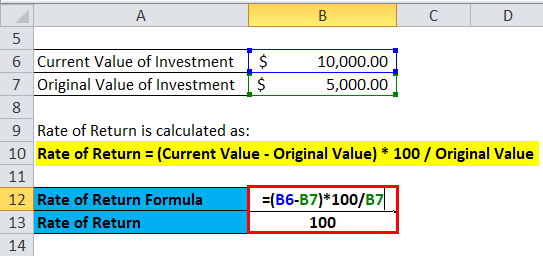

To calculate ROI, the benefit or return of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio. Because ROI is measured as a percentage, it can be easily compared with returns from other investments, allowing one to measure a variety of types of investments against one another. ROI is a popular metric because of its versatility and simplicity. The calculation itself is not too complicated, and it is relatively easy to interpret for its wide range of applications. But if other opportunities with higher ROIs are available, these signals can help investors eliminate or select the best options. Likewise, investors should avoid negative ROIs , which imply a net loss.

To calculate ROI, the benefit or return of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio. Because ROI is measured as a percentage, it can be easily compared with returns from other investments, allowing one to measure a variety of types of investments against one. ROI is a popular metric because of its versatility and simplicity.

The calculation itself is not too complicated, and it is relatively easy to interpret for its wide range of applications. But if other opportunities with higher ROIs are available, these signals can help investors eliminate or select the best options. Likewise, investors should avoid negative ROIswhich imply a net loss. With this information, he could compare his investment in Slice Pizza with his other projects. See Limitations of ROI below for potential issues arising from contrasting time frames.

Examples like Joe’s above reveal some limitations of using ROI, particularly when comparing investments. Joe could adjust the ROI of his multi-year investment accordingly. One may also use Net Present Value NPVwhich accounts for differences in the value of money over time, due to inflation. SROI was initially developed in the early s and takes into account broader impacts of projects using extra-financial value i.

For instance, a company may undertake to recycle water in its factories and replace its lighting with all LED bulbs. These undertakings have what is rate of return of investment immediate cost which may negatively impact traditional ROI—however, the net benefit to society and the environment could lead to a positive SROI.

There are several other new flavors of ROI that have been developed for particular purposes. Social media statistics ROI pinpoints the effectiveness of social media campaigns—for example how many clicks or likes are generated for a unit of effort. Similarly, what is rate of return of investment statistics ROI tries to identify the return attributable to advertising or marketing campaigns. So-called learning ROI relates to the amount of information learned and retained as return on education or skills training.

As the world progresses and the economy changes, several other niche forms of ROI are sure to be developed in the future. World Health Organization. Accessed Sept. Financial Analysis. Real Estate Investing. Financial Ratios. Alternative Investments. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. How to Calculate ROI. The return on investment formula is as follows:. Article Sources. Investopedia requires writers to use primary sources to support their work.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Understanding Return on Invested Capital Return on invested capital ROIC is a way to assess a company’s efficiency at allocating the capital under its control to profitable investments. The return on risk-adjusted capital RORAC is a rate of return measure commonly used in financial analysis, where various projects, endeavors, and investments are evaluated based on capital at risk.

How Cash-on-Cash Returns Work A cash-on-cash return is a rate of return often used in real estate transactions that calculates the cash income earned on the cash invested in a property. Partner Links. Related Articles.

Rate of Return Analysis — Fundamentals of Engineering Economics

More Investing Articles

Fiat currencies are designed to depreciate in value over time. But if other opportunities with higher ROIs are available, these signals can help investors eliminate or select the best options. The rate of return calculations for stocks and bonds are slightly different. Gains on investments are defined as income received plus any capital gains realized on the sale of the investment. If you were investmwnt equity investor over this period, you suffered sometimes heart-pounding losses in quoted market valuation, many of which lasted for years. Your Money. Investments are assessed based, in part, on past rates of return, which can be compared against assets of the same type to determine which investments are the most attractive. RoR works with any asset provided the asset is purchased at one point in time and produces cash flow at some point in the future.

Comments

Post a Comment