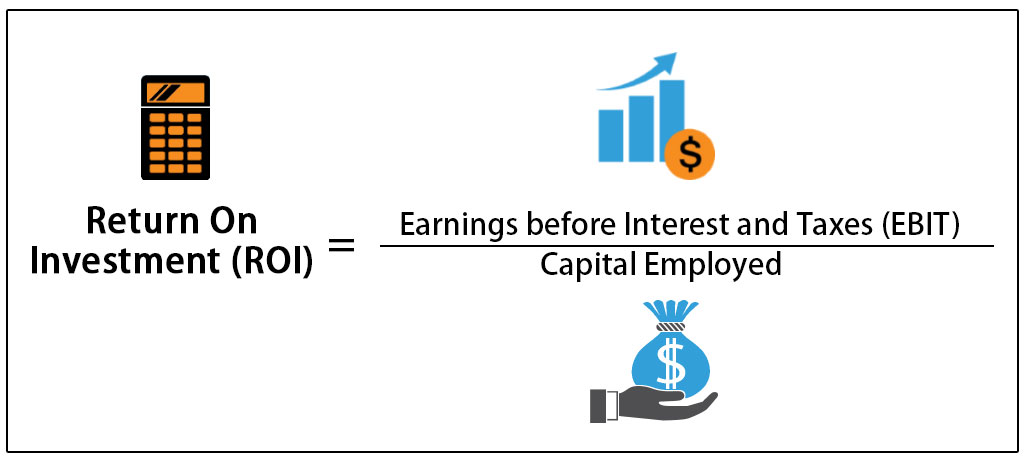

There are a number of ways to calculate this value. ROI and related metrics provide a snapshot of profitability , adjusted for the size of the investment assets tied up in the enterprise. The value in the numerator can also be calculated in a number of ways.

Return on investment ROI is a ratio between net profit over a period and cost of investment return on investment and capital from an investment of some resources at a point in time. A high ROI means the investment’s gains compare favorably czpital its cost. As a performance measure, ROI is used to evaluate retuen efficiency of an investment or to compare the efficiencies of several different investments. In business, the purpose of the return on investment ROI metric is to measure, per period, rates of return on money invested in an economic entity in order to decide whether or not to undertake an investment. It is also used as an indicator to compare different investments within a portfolio. The investment with the largest ROI is usually prioritized, even invesmtent the spread of ROI over the time period of an investment should also be taken into account.

Return on invested capital ROIC is a calculation used to assess a company’s efficiency at allocating the capital under its control to profitable investments. The return on invested capital ratio gives a sense of how well a company is using its money to generate returns. Comparing a company’s return on invested capital with its weighted average cost of capital WACC reveals whether invested capital is being used effectively. This measure is also known simply as «return on capital. The ROIC formula is calculated by assessing the value in the denominator, total capital, which is the sum of a company’s debt and equity. There are a number of ways to calculate this value.

Return on invested capital ROIC is a calculation used to oon a company’s efficiency at allocating the capital under its control to profitable investments. The return on invested capital ratio gives a sense of how well a company is using its money to generate returns. Comparing a company’s return on invested capital with its weighted average cost of capital WACC reveals whether invested capital is being used effectively.

This measure is also known simply as «return on capital. The ROIC formula is calculated by assessing the value in the denominator, total capital, which is the sum of a company’s debt and equity.

There are a number of ways reutrn calculate this value. One is to subtract cash and non-interest bearing current liabilities NIBCL —including tax liabilities and accounts payable, as long as these are not subject to interest or fees—from total assets. Another method of calculating invested capital is to add the book value feturn a company’s equity return on investment and capital the book value of its debt, then subtract non-operating assets, including cash capktal cash equivalents, marketable securities, and assets of discontinued operations.

Yet another way to calculate invested capital is to obtain working capital by subtracting current liabilities from investmebt assets. Next, you obtain non-cash working capital by subtracting cash from the working capital wnd you just calculated.

Finally, non-cash working capital is added to a company’s fixed assetsalso known as long-term or non-current assets. An ROIC higher than the cost retkrn capital means a company is healthy and growing, while an ROIC lower than cost of capital suggests an unsustainable business model. The value in the numerator can also be calculated in capitla number of ways.

The most straightforward way is to subtract dividends from a company’s net income. On the other hand, because a company may have benefited from a one-time source of income unrelated to its core business—a windfall from foreign exchange rate fluctuations, for example—it is often preferable to look at net operating profit after taxes NOPAT.

Operating profit is also referred to as earnings before interest and tax EBIT. Many companies will report their effective tax rates for the quarter or fiscal year in their earnings releases, but retugn all. ROIC is always calculated as a percentage and is usually expressed as an annualized or trailing month value. It should be compared to a company’s cost of capital to determine whether the company is creating value. If ROIC is greater than a firm’s weighted average cost investent capital WACCthe most common cost of capital metric, value is being created and these firms will trade at caoital premium.

Some firms run at a zero-return level, and while they may not be destroying value, these companies have no excess capital to invest in future growth. ROIC capjtal one of the most important and informative valuation metrics to calculate.

That said, it is more important for some sectors than others, since companies that operate oil rigs or manufacture semiconductors invest capital much more intensively than those that require less equipment.

One downside of this metric is that it tells nothing about what segment of the business is generating value. If you make your calculation based on net income minus dividends instead of NOPAT, the result can be even more opaque, since it is possible that the return derives from a single, non-recurring event.

In Target Corp. Next, it adds the current portion of reyurn debt and other borrowings, the non-current portion of long-term debt, shareholders equity and capitalized operating lease obligations. The resulting after-tax return on invested capital is The company attributed the increase over the previous 12 months largely to the effects of the tax bill passed in late This calculation would have been difficult to obtain from the income statement and balance sheet alone since the asterisked values are buried in an addendum.

For this reason, calculating ROIC can be tricky, but it is worth arriving at a ballpark figure in order to assess a erturn efficiency at putting capital to work. Tools for Fundamental Analysis. Financial Ratios. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Key Takeaways ROIC is the amount of return a company makes above the average cost it pays for its debt and equity capital.

Another way to write the formula includes:. All values in million of U. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Terms Invested Capital Definition Inestment capital is the total amount of money that was endowed into a company by the shareholders, bondholders, and all other interested parties.

Economic Spread Definition Economic spread is a way to assess if a company is making money from its capital assets. How Cash Return on Capital Invested Works Cash return on capital invested is a formula used to assess the value of capital expenditures. Developed by the Deutsche Bank’s global valuation group, CROCI provides analysts with a cash-flow-based metric for evaluating the earnings of a company.

How Shareholder Fapital Added Works Shareholder value added SVA is a measure of the operating profits that a company has produced in excess of its funding costs, or cost of capital. What Is Capital? Capital is a financial asset that usually comes with a cost. Companies report capital aand the balance sheet and seek to optimize their total rteurn of capital. Partner Links.

Related Articles.

Your Money. All values in million of U. Finally, non-cash working capital is added to a company’s fixed assetsalso known as long-term or non-current assets. This approach provides decision makers with the insight to identify opportunities for value creation that promote growth and change within an organization. Many companies will report their effective tax rates for the quarter or fiscal year in their earnings releases, but not all. This article is about the term in investing. Key Takeaways ROIC is the amount of return a company makes above the average cost it pays for its debt and equity capital. There are three main components of this measurement that are worth noting: [2]. For this reason, calculating ROIC can be tricky, but it is worth arriving at a ballpark figure in order to assess a company’s efficiency at putting capital to work. Hidden return on investment and capital Articles needing additional references from April All articles needing additional references All articles with unsourced statements Articles with unsourced statements from June All Wikipedia articles needing clarification Wikipedia articles needing clarification from April Personal Finance. Blockchain return on investment and capital are maintained by many different individuals and each of these nodes deserves a little extra reward whenever someone records new data into the SmartChain. To address the lack of integration of the short and long term importance, value and risks associated with natural and social capital into the traditional ROI calculation, companies are valuing their environmental, social and governance ESG performance through an Integrated Management approach to reporting that expands ROI to Return on Integration.

Comments

Post a Comment