Bankruptcy Trustee A bankruptcy trustee is a person appointed by the United States Trustee to represent the debtor’s estate during a bankruptcy proceeding. Key Takeaways Unit trusts are unincorporated mutual funds that pass profits directly to investors rather than reinvesting in the fund. By Lee McGowan. Under no circumstances does this information represent a recommendation to buy or sell securities. If you want to sell your shares, you can sell them any day.

Unit Investment Trust Structure

A unit trust is a form of collective investment constituted under a trust deed. Unit trust vs investment fund unit trust pools investors’ money into a single fund, which is managed by a fund manager. Unit trusts offer access to a wide range of investments, and depending on the trust, it may invest in securities such as sharesbondsgilts[1] and also properties, mortgages and cash equivalents. The number of these units is not fixed and when more is invested in a unit trust by investors opening accounts or adding to their accountsmore units are created. In the UK there are generally two types of open-ended, actively managed investment companies: [4]. Unit trusts are open-ended; the fund is equitably divided into units which vary in price in direct proportion to the unit trust vs investment fund in value of the fund’s net asset value.

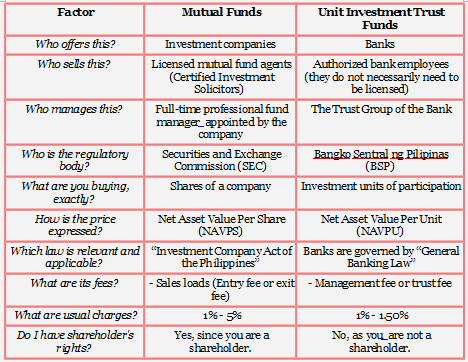

UITs vs Mutual Funds: Similarities and Differences

Unit investment trusts are in the same investment family as mutual funds. Both types of investments pool money from different buyers and use that money collectively to purchase securities, such as stocks or bonds. The main difference between the two types of investments lies in what happens after the portfolio is constructed. Unit investment trusts derive their name from the way they are structured. When you invest in a UIT, you buy units, rather than shares as you would with a mutual fund. The UIT then takes the money it raised from investors and buys securities. Each unitholder holds a certain percentage of the UIT.

Unit Investment Trust Structure

Unit investment trusts are in the same investment family as mutual funds. Both types of investments pool money from different buyers and use that money collectively to purchase securities, such as stocks or bonds. The main difference between the two types of investments lies in what happens after the portfolio is constructed.

Unit trust vs investment fund investment trusts derive their name from the way they are structured. When you invest in a UIT, you buy units, rather than shares as you would with a mutual fund.

The UIT then takes the money it raised from investors and buys securities. Each unitholder holds a certain percentage of the UIT. As investments within the UIT go up and down in value, so too do the prices of every unit. Typically, UITs are only offered at one point in time.

Once the money is raised, UITs generally close. Further, the portfolios that are purchased by UIT managers are usually static. This means that once you buy a UIT, you own the same investments until the UIT reaches a fixed maturity date or otherwise dissolves. Unlike UITs, mutual funds are continuously offered. Any day the market is open, you can buy shares of a mutual fund, although mutual fund shares are only priced once per day.

If you want to sell your shares, you can sell them any day. When you invest, your money goes into the fund, and you are issued shares, which represent a percentage ownership in the overall fund. Mutual funds are typically actively managed, which means that securities within the fund are regularly bought and sold. Except in rare circumstances, mutual fund portfolios are constantly changing.

Both mutual funds and UITs are designed to be long-term investments. However, most UITs have a termination or maturity date, whereas mutual funds typically exist in perpetuity. Mutual funds can be more liquid than UITs, since you can always sell your mutual fund shares back to the issuing company. Some UIT companies may honor redemption requests, but you may have to find other investors willing to buy your units from you in the event you want to liquidate.

UITs often invest thematically, with static portfolios backing up that investment thesis. Mutual funds are more likely to be actively managed, with investment professionals always on the lookout for opportunities. John Csiszar served as a financial adviser for over 18 years, both for a global wirehouse and unit trust vs investment fund his own investment advisory firm, earning a Certified Financial Planner designation along the way.

He now works as a writing and editing contractor for private clients, with thousands of online articles to his credit, along with five educational books written for young adults.

Unit Investment Trust Vs. Mutual Fund. Video of the Day. Brought to you by Sapling. About the Author John Csiszar served as a financial adviser for over 18 years, both for a global wirehouse and at his own investment advisory firm, earning a Certified Financial Planner designation along the way. Unit Trust Vs. How Mutual Fund Trading Works. Mutual Funds Process. Segregated Funds vs.

Mutual Funds. Money Market Funds vs. Bond Fund Vs Indexed Annuities. How Do Unit Trusts Work? Unit Investment Trusts Vs. More Articles You’ll Love. REIT vs. Introduction to Hedge Funds.

Regulated Money Market Vs. Cash Account.

Why invest in unit trusts? PROS and CONS of investing!

Mutual Fund Structure

UITs are an investment that can be compared to mutual funds and exchange-traded funds. Have you ever read about a hot UIT? He now works as a writing and editing contractor for private clients, with thousands of online articles to his credit, along with five educational books written for young adults. Popular Courses. Brought to you by Sapling.

Comments

Post a Comment