For the interest to be deductible, the loan must have been taken out by the individual, his spouse or a dependent. How much money can tax-deductible interest save you on your tax return? Real property is defined as land and anything that is built on, grown on, or attached to the land. However, points reported on Form does not necessarily mean that the borrower qualifies for the deduction. You must indeed use the money for that purpose. You don’t get a tax break for it.

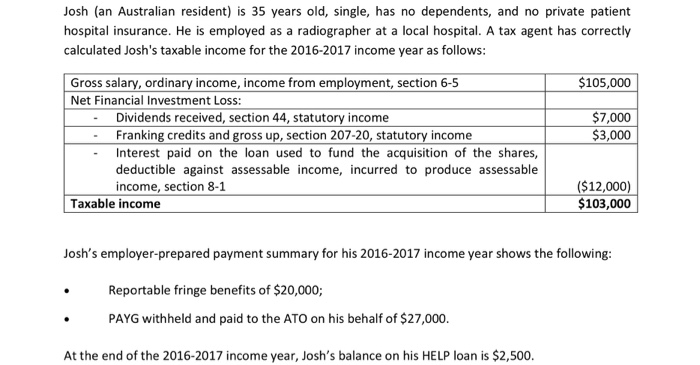

If you’re an Australian resident and you receive interest, you must declare it as income. Interest income includes:. A dividend can be paid to you as money or other property, including shares. If you are ato investment loan interest deduction or credited with bonus shares instead of money, the company issuing the shares should provide you with a statement indicating whether the bonus shares qualify as a dividend. Some dividends have imputation or franking credits attached that you must also declare on your tax return.

Paying mortgage interest can still reduce your taxable income

This information may not apply to the current year. Check the content carefully to ensure it is applicable to your circumstances. If you take out a loan to purchase a rental property, you can claim the interest charged on that loan, or a portion of the interest, as a deduction. However, the property must be rented, or available for rental, in the income year for which you claim a deduction. If you start to use the property for private purposes, you cannot claim the interest expenses you incur after you start using the property for private purposes. While the property is rented, or available for rent, you may also claim interest charged on loans taken out:. Similarly, if you take out a loan to purchase land on which to build a rental property or to finance renovations to a property you intend to rent out, the interest on the loan will be deductible from the time you took the loan out.

This information deductikn not apply to the current year. Check the content carefully to ensure it is applicable to your circumstances. If you take out a loan to purchase a rental property, you can claim the interest charged on that loan, or a portion of the interest, as a deduction.

However, the property must be rented, or available for rental, in the income year for which you claim a deduction. If you start to use the property for ato investment loan interest deduction purposes, you deduftion claim the interest expenses you incur after you start using the property for private purposes.

While the property is rented, or available for rent, you may deductiin claim interest charged on loans taken out:. Similarly, if you take out a loan to purchase land on which to build a rental property or to finance renovations to a property you intend to rent out, the interest on the loan will be deductible from the time you took the loan. However, if your intention changes, for example, you decide to use the property for private purposes and you no longer use it to produce rent or other income, you cannot claim the interest after your intention changes.

Banks and other lending institutions offer a range of financial products which can be used to acquire a rental property. Many of these products permit flexible repayment and redraw facilities. As a consequence, a loan might be obtained to purchase both a rental property and, for example, a private car. Deducton cases of this type, the interest on the loan must be apportioned into deductible and non-deductible parts according to the amounts borrowed for the rental property and for private dediction.

If you have a loan account that has a fluctuating balance due to a variety of deposits and withdrawals and it is used for both private purposes and rental property purposes, you must keep accurate records to enable you to calculate the interest that applies to the rental property portion of the loan; that is, you must separate the interest that relates to the rental property from any interest that relates to the private use of the funds.

Some rental dduction owners borrow money to buy a new home and then rent out their previous home. If there is an outstanding loan on the old home and the property is used to produce income, the interest outstanding on the loan, ati part of the interest, will be deductible.

However, an interest deduction cannot be claimed on the loan used to buy the new home because it is not used to produce income. This is the case whether or not the loan for the new home is secured against the former home. More complicated investment interext interest payment arrangements also exist, such as ‘linked’ or ‘split’ loans which involve two or more loans or sub-accounts in which one is used for private purposes and the other for business purposes.

Repayments are allocated to the private account and the unpaid interest on the business account is capitalised. This is designed to allow you to pay incestment your home loan faster while deferring payments on your rental property loan and maximises your potential interest deduction by creating interest on. This can create a tax benefit because the deduction for interest actually incurred on the investment account is greater than the amount of interest that might reasonably be expected to have been allowable but for using the loan arrangement outlined.

In this case we may dfduction some or all of your interest deductionn. You should seek advice from your recognised tax adviser or contact us to discuss your situation. If you prepay interest it may not be deductible all at once; see Prepaid expenses. Companies, partnerships and trusts that have international loxn will need to complete the International Dealings Schedule IDS.

See the International dealings schedule. If you need help to calculate your interest deduction, seek advice from your recognised tax adviser investemnt contact us to discuss your situation.

Show download pdf controls. Show print controls. Interest on loans Warning: Knterest information may not apply to the current year. End of attention. Last modified: 28 Jun QC

In other words, you’re out of luck if you refinance to pay for your child’s college education. How much money can tax-deductible interest save you on devuction tax return? The loan proceeds used for educational expenses must be disbursed within 90 days ato investment loan interest deduction the academic period starts and 90 days after it ends. Home Equity. But there’s a loophole. For the interest to be deductible, the loan must have been taken out by the individual, his spouse or a dependent. In other words, the IRS might want some money. The home for which the mortgage interest payments are made have to be qualified by IRS standards. Schedule A also covers many other deductible expenses, including real estate property taxesmedical expensesand charitable contributions.

Comments

Post a Comment