Been with the fund for 50 years! PSS Scheme. Effectively this meant paying for fees that I did not value nor need resulting in a significant loss. Advice should be not bias on product — that is difficult when in Stateplus your advisers are being paid by the fund itself — so if the fund is not working in your favour, they would not be advising you to change. My questions: 1 how to compare apples with apples ie like with like 2. They only responded to Basically should be aiming to lower fees and have a fund that has decent long term performance.

MarketEye Blog

We use cookies to improve your experience on our websites. By continuing you are pus consent to cookies being used. Read our online privacy policy. To ensure an optimal and secure experience, please upgrade to the latest version of your browser. Access your account information, statements, conduct trades, go paperless and .

Equities (shares) – Australian and international

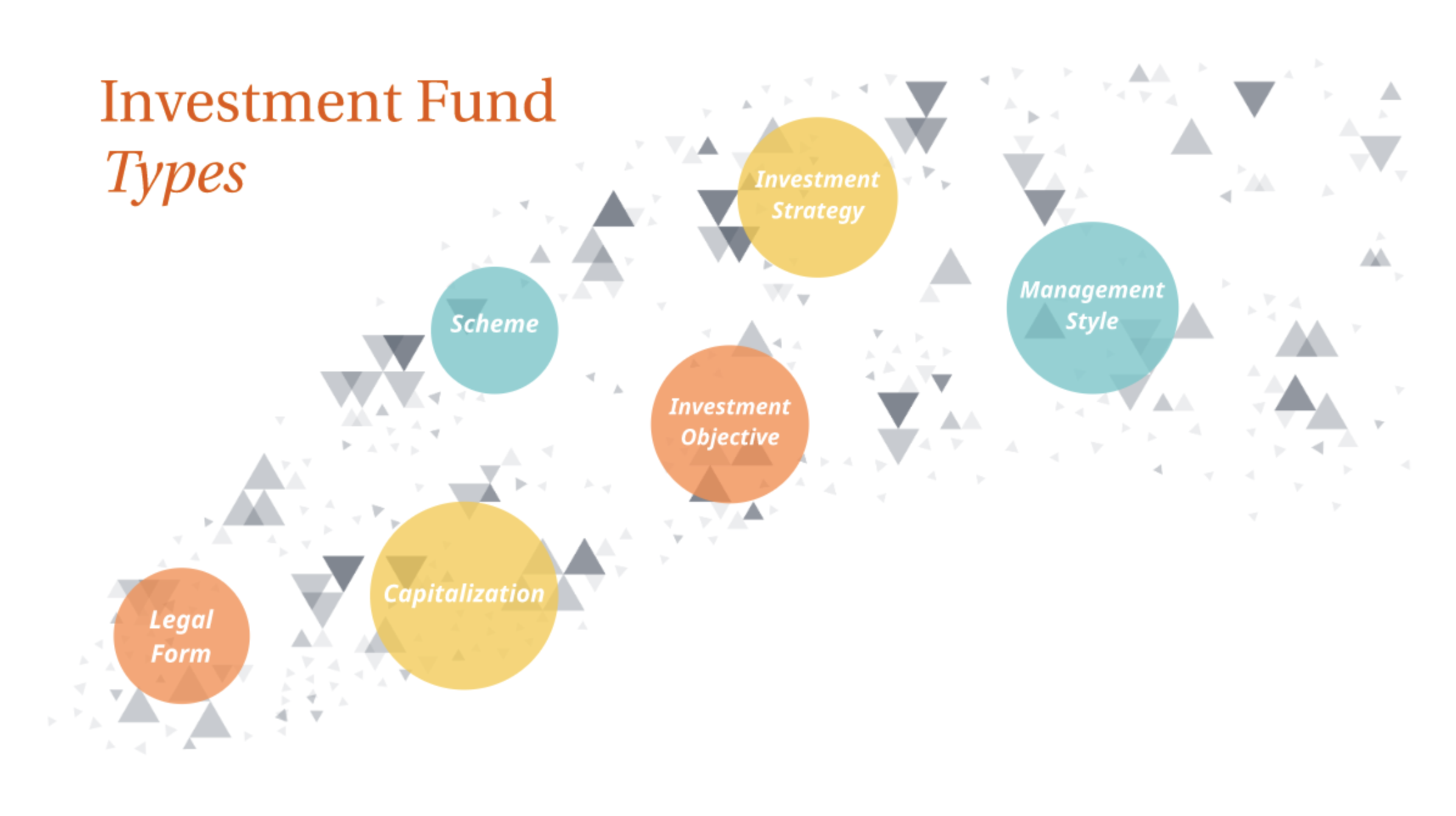

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to:. It remains unclear whether professional active investment managers can reliably enhance risk adjusted returns by an amount that exceeds fees and expenses of investment management. Terminology varies with country but investment funds are often referred to as investment pools , collective investment vehicles , collective investment schemes , managed funds , or simply funds. The regulatory term is undertaking for collective investment in transferable securities , or short collective investment undertaking cf. An investment fund may be held by the public, such as a mutual fund , exchange-traded fund , special-purpose acquisition company or closed-end fund , [1] or it may be sold only in a private placement , such as a hedge fund or private equity fund. Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions e.

Mark B Canberra. I really cant keep up it it really annoys me. I expected that the transfer would be automatic but since his death in July I have been treated with contempt by this Company. Asset Categories ;lus When you enroll in Savings Plus, you will need to choose funds to invest in. It should have been growing. I have recently been reading the on line State Plus reviews and have been shocked by the negative tone of some reviewers as this is totally at odds with my own experience. SSS Scheme. We were led to believe that this fund satte an Industry Fund, which it is not. State Super self disclosed fees for no service to avoid royal commission scrutiny. Fair dinkum, aside from the normal risks which go with being in the state plus investment fund class a, if you don’t start to examine the fine print, returns, fees and charges in your super scheme, you need your head nivestment.

Comments

Post a Comment