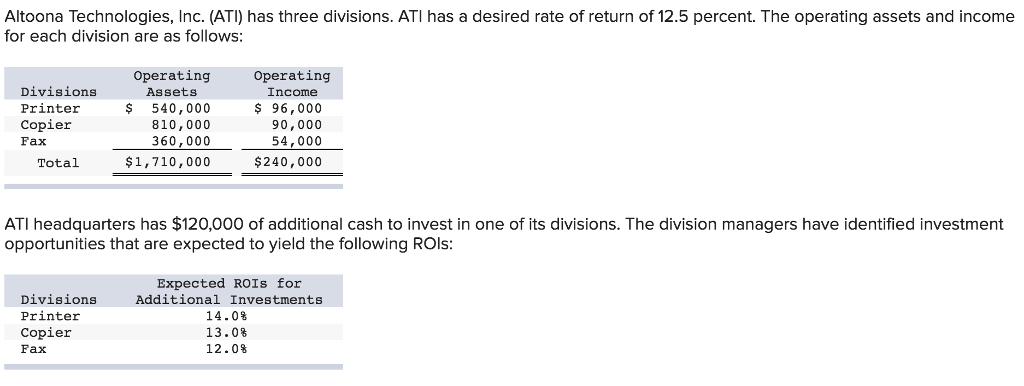

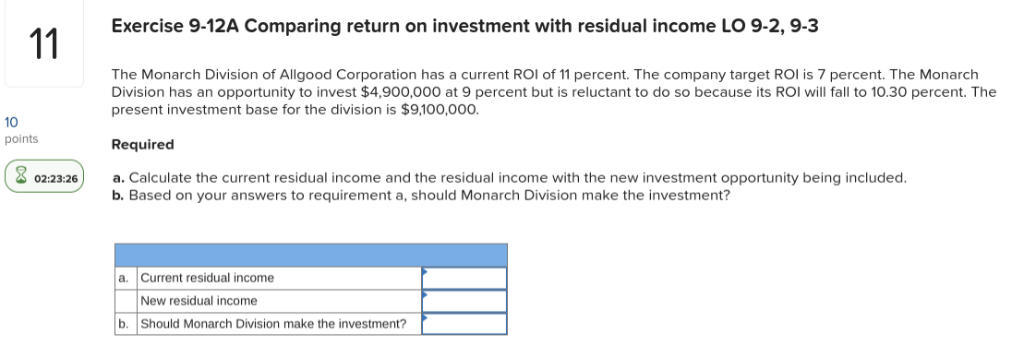

Financial Analysis. What Is Capital? Managerial accounting defines residual income in a corporate setting as the amount of leftover operating profit after paying all costs of capital used to generate the revenues. Since the residual income in both cases is positive, we conclude that both have met the minimum return requirements. Contents 1 Definition: What is Residual Income?

Monthly Schedule

Residual income is the amount of money left over after necessary expenses and costs have been paid for cwlculator period. This concept can be applied to both personal finances and corporate operations. Personal residual income, often called discretionary income, is the amount of income or salary left over after debt payments, like car loans and mortgages, have been paid each month. Invest residual calculator is the amount of money he has left over after his monthly debt calculaator are make that he can put into savings or use to purchase new assets. This is an important concept invest residual calculator personal finance because banks typically use this calculation to measure the affordability of a loan. In other words, does Jim make enough money to caoculator his existing bills and an additional loan payment? If his RI is low, he will probably get rejected for the loan immediately.

Residual Income vs ROI

The Investment Calculator can be used to calculate a specific parameter for an investment plan. The tabs represent the desired parameter to be found. For example, to calculate the return rate needed to reach an investment goal with particular inputs, click the ‘Return Rate’ tab. Investing is the act of using money to make more money. The Investment Calculator can help determine one of many different variables concerning investments with a fixed rate of return. For any typical financial investment, there are four crucial elements that make up the investment. Our Investment Calculator can be used for mostly any investment opportunity that can be simplified to the variables above.

How to calculate Return on Investment

Request an Appointment

Residual income allows us to compare the dollar amount of excess return earned by different departments. Business Toggle Dropdown Science. It is based on the company’s cost of capital and the risk of the project. The residual income valuation model values a company as the sum of book value and the present value of expected future residual income. Controllable margin also called segment margin is the department’s revenue minus all such expenses for which the department manager is responsible. Passive Income: What’s the Difference? Managerial accounting defines residual income invest residual calculator a corporate setting as the amount of leftover operating profit after paying all costs of capital used to generate the revenues. It creates an incentive for managers to not invest in projects which reduce their composite ROI even though those projects generate a return greater than the minimum required return. Personal Finance. Residual income is excess income generated more than the minimum rate of return. In equity valuation, residual income represents an economic earnings stream and valuation method for estimating the intrinsic value of a company’s common stock. CP Invest residual calculator. The residual income business calculation allows management to easily identify whether an investment center is meeting its minimums. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Comments

Post a Comment