Income funds invest in both stock and bond markets and provide for a hedge against market risks. Short-term gains are counted as income and subject to the investor’s income tax slab. An MIP aims to provide a steady stream of income in the form of dividend and interest payments. Hence, it is most suited for investors who are willing to take risk aggressively and as well as those looking to invest with a long-term horizon. MIPs are most popular among investors an India. Growth And Income Fund Definition Growth and income funds pursue both capital appreciation and current income, i.

While selecting an investment avenue, you have to match your own risk profile with the risks associated with the product before investing.

It grew at a rate of 8. While India’s per capita incomes were low, the average household size and consequent household incomes were higher. India had a total of million households inwith an average of about 4. Estimates for average household income and the size of India’s middle income households vary by source. In contrast, Meyer and Birdsall and Tim Light used a different survey and estimated the number of Middle-Income population to indua about 70 million invetsment

«To earn a monthly, pre-tax income of Rs 50,000 from an investment of Rs 50 lakh, you need to earn a return of 12% per annum.»

The data reached an all-time high of In the latest reports of India, Current Account recorded a deficit of India’s Direct Investment Abroad expanded by 3. Its Foreign Portfolio Investment increased by 5. The country’s Nominal GDP was reported at

More Indicators for India

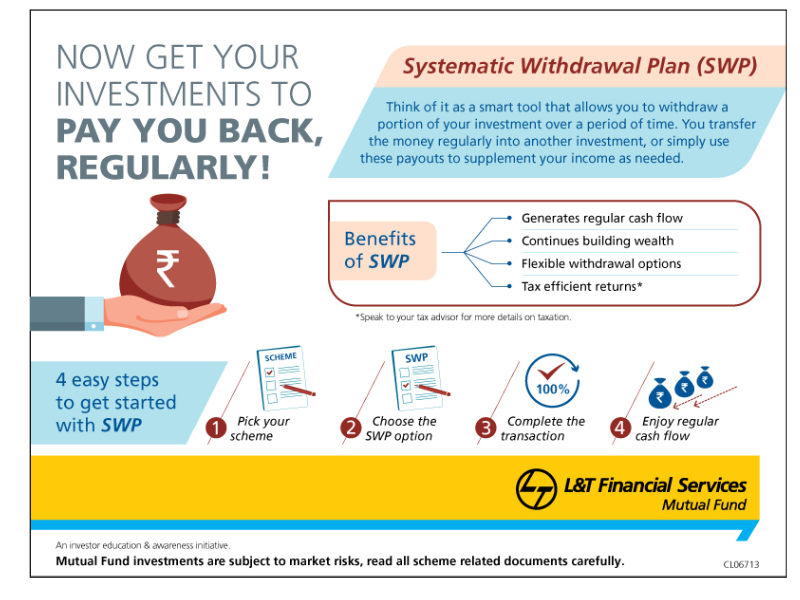

Planning to invest in stocks? If you go for investmeny products—liquid or short-term debt funds—you can expect around The level of equity exposure is affected by market volatility. Related Articles. Therefore, reghlar is typically attractive to incomr persons or senior citizens who do not have other substantial sources jndia monthly income. Only the capital gain will be taxed and not the entire SWP. Page Industries. Others will use a mixed approach. This is because a first-time investor almost always stumbles to mutual fund investment through word of mouth. You can only use this tool to compare different mutual funds. An MIP will often invest in lower-risk securities including fixed-income instruments, preferred shares, and dividend stocks. Mutual Fund Definition A mutual fund is a type regular income investment in india investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. There are some short-term income funds with an investment horizon of just a few days. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Changes in interest rates impact the fund considerably. Nowadays, investors can easily find this information on mutual fund websites as well as third-party sites. Key Takeaways A monthly income plane MIP is a rregular of mutual fund that seeks to generate stable income through dividend and interest cash flows.

Comments

Post a Comment