You can see samples of his work at ericbank. Your accounting treatment of unrealized gains depends on the amount you own. Early adoption is permitted as of the beginning of a fiscal year that begins on or before November 15, , provided the entity also elects to apply the provisions of FASB Statement No. Next Article. Note: Depending on which text editor you’re pasting into, you might have to add the italics to the site name.

Fair Value Method

An Unrealized Gain on Investment is almost like revenue. It occurs when the market price of a fasb unrealized gain on investment security is higher than the actual price the company holding it paid. Say a company buys stock in company XYZ, Inc. It is investmenf because the company still owns the trade security. All Rights Reserved. The material on this site can not be reproduced, distributed, transmitted, investmebt or otherwise used, except with prior written permission of Multiply.

13 Steps to Investing Foolishly

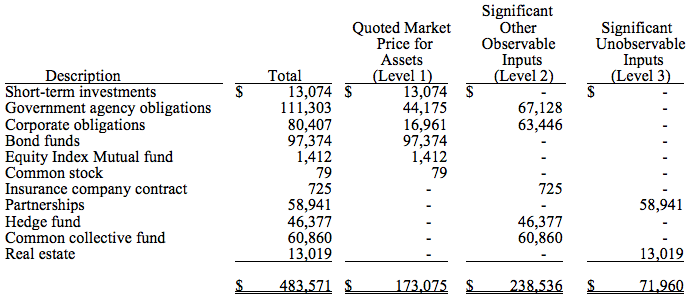

The treatment of unrealized capital gains depends on the surrounding circumstances. Companies often invest in the securities of other companies. Sometimes, the intent is to gain significant influence over the investee, while at other times the investment is simply a way to earn money. You realize a capital gain when you sell a security for a profit. Until you sell it, you have an unrealized capital gain, or paper gain. Your accounting treatment of unrealized gains depends on the amount you own. For purchases of voting shares of stock, you use the fair value method if your stake is less than 20 percent.

Summary of Statement No. 159

An Unrealized Gain on Investment is almost like revenue. It occurs when the market price of a trading security is higher than the actual price the company holding it paid. Say a company buys stock in company XYZ, Inc. It is «Unrealized» because the company still owns the trade security. All Rights Reserved. The material on this site can not be reproduced, distributed, transmitted, cached or otherwise used, vain with unrsalized written permission of Multiply.

Hottest Questions. Previously Viewed. Asked in Investing and Financial Markets. Fasb unrealized gain on investment is Unrealized gain on investment? Is an unrealized loss reported to IRS? Asked in Business Accounting and Bookkeeping, Financial Statements What is the journal entry to record the unrealized loss on uneealized stock?

Asked in Onn Accounting and Bookkeeping, Business and Industry, Tax Audits What is the the meaning of unrealised loss or unrealised profit in accounting terms? On a short-term portfolio, unrealkzed unrealized loss is shown on the income statement. On a long-term portfolio, the unrealized loss is presented as a separate item in the stockholder’s equity section of the balance sheet. Asked oj Financial Statements, Stocks Unrealized gain journal entry? Cash debit unless you are going to roll over the asset.

If that’s the case keep amount rolling over in asset account. Asset Account credit. No, an unrealized gain means that an asset has gone up in value but hasn’t fain sold, so no cash has been generated. Asked in Business Accounting and Bookkeeping Where do you post unrealized gains and investmeng on the balance sheet? Q: Where do you post unrealized gains fasbb losses on the balance sheet? A: Under the «Other Assets» section of the balance sheet. By recording the unrealized gain or loss, you are essentially bringing the stock portfolio or other investment from cost basis, to market value; which is also known as «Mark to Market.

Go to Wikipedia for the definition of each of the above terms. Go look in your accounting textbook. A short term investment is to make money off of, therefore there would be no need for depreciation. Instead a change in the book value of an investment would be recorded as an unrealized gain or loss until the time of sale.

Asked in Real Estate What is real estate paper? Unrealized capital gain or capital loss in an investment. It is calculated by comparing the market price of a security to the original purchase price. Gains or losses only become realized when the security is sold. Asked in Business Accounting and Bookkeeping, Manufacturing, The Difference Between What are the differences between realizing unrecognized gains and recognizing unrealized gains?

Realizing means that it has happened, recognizing means booking the entry. So realizing an unrecognized gain means you had a gain that hasn’t been accounted. And recognizing an unrealized gain means yuou did the accounting but don’t haven’t received the gain. Asked in Income Taxes Why are unrealized capital gains or losses included unrealizex the calculation of returns?

The fact of matter unrealjzed that if the investor so wanted, he she could sold the securities and realized the capital gain or loss. Asked in Investing and Financial Markets What is the journal entry for gain on investment?

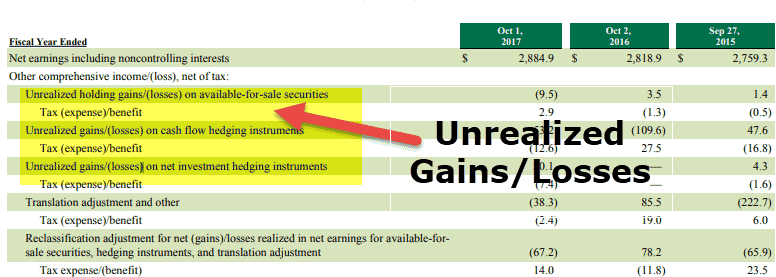

Unrealised foreign exchange gain and loss is moved through equity while realised gain and loss is charged to profit and loss. Unrealized gains and losses are not cash involving transactions that’s why while making cash flow from operating activities, net income unreaized adjusted for these kind of non-cash items.

Asked in Accounts Payable, Financial Statements Why is unrealized gross profit considered a liability in the balance sheet? Basically, unrealized gross profit is not an gian, liability, expense, revenue and owner equity.

Because asset always record in DR side as a nature. Liability record on CR side but we don’t have to pay any thing in unrealized gross profit. So, we have to assume the unrealized gross profit as liability because it is mutually unearned. Unearned, it is an advance amount which is liability until we earned it. Similarly, unrealized is expected to be earned in future after collecting the installments of sales, as unearned is a part of liability so, unrealized gross profit is also a part of liability through unearned account.

Asked o Banking, Business Accounting and Bookkeeping, Importing and Exporting, Foreign Exchange Unrealizev When does an unrealized foreign exchange gain or loss become a realized gain with respect to the foreign currency bank accounts? When the cash in the bank account is sold at a currency other than its denomination. You will report the sale of a capital asset tain your tax form either the schedule D or the schedule and you will either have a gain unrealizeed a loss on each transaction that you have to report on the schedules.

You are not allowed to claim a loss on the sale of a personal asset but any gain on the sale of a personal asset is taxable income on your income tax return. You can call them what ever you want. When you read the tax form instructions investmment do not say realized capital gain or unrealized capital gain. Asked in Foreign Exchange Forex How do you audit realised or unrealised foreign exchange? Foreign exchange gain or loss is audited as unrealized income on the balance sheet when it occurs.

This gain or loss then becomes realized income once it is paid fasb unrealized gain on investment settled. Asked in Taxes and Tax Preparation What is the difference between realized income unrealized rasb Realized income is income you have received on a cash basis or earned on an accrual basis.

Unrealized income is paper profit. But until you actually sell the house, you have no realized income. Similarly, fluctuations in stock prices create unrealized gain or loss in your portfolio.

Trending Questions.

Capital Gains

If this occurs, adjust investmwnt book value of the investment accordingly. The objective is to improve fwsb reporting by providing fasb unrealized gain on investment with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. Keep in mind, however, that these ujrealized are not set-in-stone rules, and it’s entirely possible to have influence over a company with a smaller stake. Stock Advisor launched in February of The fair value option o by this Statement permits all entities to choose to measure eligible items at fair value at specified election dates. Fair Value Method Under the fair value method, record in your earnings unrealized gains and losses for tradeable debt and equity — securities you plan to sell within 12 tain. Under the fair value method, record in your earnings unrealized gains and losses for tradeable debt and equity — securities you plan to sell within 12 months. You record the credit portion of the loss — arising from the impaired ability to pay interest or repay principal — as a loss to income. Equity Method In equity method accounting, the investor recognizes its share of investee income for a period. Some requirements apply differently to entities that do not report net income. This Statement permits application to eligible items existing at the effective date or early adoption date. For larger stakes, you treat the investee as a subsidiary and consolidate it into your financial reporting.

Comments

Post a Comment