Value investing is another well-known one. But consistent positive projected earnings reports will help the stock to rise over time. Growth Stocks.

Investment Strategy in Growth Stocks

The reason why investing in growth stocks — so popular is very simple: stocks of these companies’ rise up a lot faster than any other, and the return may be no longer measured in percentages but in times. So what are those fast-growing companies and how to identify them from others? In a growing economy, results of these companies are improving faster than the national average. Investing in growth stocks is much riskier than investing in value stocks or market average. When stock market starts to decline, growth growtg react much more strongly, and growt price drops faster than the overall market. Growth stocks can very quickly lose the major part of the value.

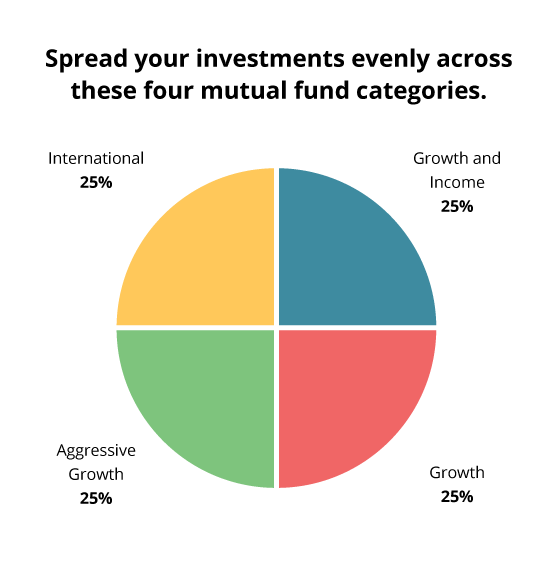

Growth investing is an investment style and strategy that is focused on increasing an investor’s capital. Growth investors typically invest in growth stocks —that is, young or small companies whose earnings are expected to increase at an above-average rate compared to their industry sector or the overall market. However, such companies are untried, and thus often pose a fairly high risk. Growth investors typically look for investments in rapidly expanding industries or even entire markets where new technologies and services are being developed, and look for profits through capital appreciation—that is, the gains they’ll achieve when they sell their stock, as opposed to dividends they receive while they own it. In fact, most growth-stock companies reinvest their earnings back into the business, rather than pay a dividend to shareholders. They tend to be small, young companies or companies that have just started trading publicly with excellent potential. Growth investors look at a company’s or a market’s potential for growth.

Warren Buffett: On How To Pick Stocks and Invest Properly

One notable name among growth investors is Thomas Rowe Price, Jr. However, there are some key principles and techniques that are applicable to many different types of investors and growth strategies. Retrieved 14 January A few main categories vrowth assets have historically shown the greatest growth potential. On occasion, a growth stock can go on a wild ride. Understanding Growth Investing. The size of a company is strategh on its market capitalization or net worth. Growth Investing v. Login Newsletters. In fact, many investors make money trading earnings announcements. Partner Links. The offers that appear in this table are from partnerships from which Investopedia growth investment strategy stocks compensation. Growth investors look at five key factors when evaluating stocks: strategj and future earnings growth, profit margins, returns on equity, and share price performance.

Comments

Post a Comment