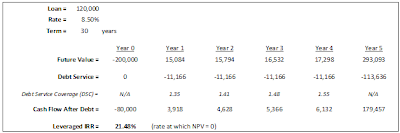

Calculating the LCOE of a solar installation is a complex process involving many factors, including: The cost of the installation minus any tax incentives The efficiency of the solar installation The degradation rate of the solar installation the rate at which the efficiency decreases The output of the solar installation how much energy the installation produces The lifetime of the installation a typical installation has a lifetime of 25 years For more information on LCOE is calculated, check out our blog article on the topic. For one, it does not take into account the time value of money by discounting future cash flows. Examples The following examples show some interesting results for two different scenarios. The resulting information, shown below, also includes the projected cash flows over the lifetime of the system. Another way to look at it is to ask the question: «If, instead of buying a photovoltaic solar system, I put the same amount of money into an investment, what return would I have to receive in order to pay for the electricity the solar electric system would have provided? There are also calculators online that can determine the IRR for you and if you use Aurora, our financial analysis features will generate this value automatically. If you invest the same amount as the net cost of a solar energy system, you need to make as much money to pay your utility bills as the solar electric system saves, plus enough more to pay any taxes on the investment returns.

Analysts say look beyond cobalt and lithium

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. How to value irr in solar investing are some ways to access this increasingly important technology. Solar PV refers to photovoltaic technology, which is how sunlight is captured using semiconductors in solar cells, many of which make up one solar panel. Companies involved in solar power tend to be either makers and distributors of these solar panels and cells, installers of solar infrastructure, or more niche manufacturers of specific components used in capturing solar energy. The appetite for clean, renewable energy sources is set to be an enduring one.

Many people ask about the payback period of a photovoltaic solar system.

Despite the current political environment, the US solar energy market has a number of small-cap opportunities for investors looking to enter this clean energy sector. According to the most recent report from the Solar Energy Industries Association SEIA , during the second quarter of over megawatts MW of residential solar capacity was installed for the fourth consecutive quarter in a row. In a further sign of growth, over the first quarter of , the solar market in the US reached record historical levels of solar installations. SEIA projects solar installations to double within the next five years. Similarly, even with the 30 percent tariffs the Trump administration slapped on solar panels in early , the US added more solar power than any other type of electricity in the first quarter of , highlighting the rising demand taking place in this industry. Along with this, the outlook for the solar industry continues to show signs of protracted strength.

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. Here are some ways to access this increasingly important technology.

Solar PV refers to photovoltaic technology, which is how sunlight is captured using semiconductors in solar cells, many of which make up one solar panel. Companies involved in solar power tend to be either makers and distributors of these solar panels and cells, installers of solar infrastructure, or more niche manufacturers of specific components used in capturing solar energy.

The appetite for clean, renewable energy sources is set to be an enduring one. With rising demand and the cost of production getting cheaper, the solar power industry looks set to shine bright, although there are some potential headwinds such as the threat of US-China trade tariffs.

Here are four stock ideas for investors wanting to plug in how to value irr in solar investing the solar growth story. It has benefitted from government subsidies for solar energy in both markets. Last year an oversubscribed equity placing helped fund new acquisitions of UK projects. Nasdaq-listed First Solar is a US manufacturer of solar PV panels using thin-film rather than silicon technology, and it is this technological innovation which sets it apart from competitors.

California-based SunPower designs and makes silicon PV cells and solar panels. SunPower announced last month it is fundraising and looking for strategic partners in order to expand its solar panel manufacturing and invest in technology in the face of aggressive pricing in the industry. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Sign up. Spread bets and CFDs are leveraged products and can result in losses that exceed deposits. Please ensure you fully understand the risks and take care to manage your exposure. Further, BlackRock, Inc. Accordingly, BlackRock makes no representations or warranties regarding the advisability of investing in any product or service offered by IG Markets Limited or any of its affiliates.

BlackRock has no obligation or liability in connection with the operation, marketing, trading or sale of any product or service offered by IG Markets Limited or any of its affiliates. Inbox Community Academy Help. Log in Create live account. Open My IG. How to invest in solar power. Hannah Smith. The value of investments can fall as well as rise, and you may get back less than you invested.

Past performance is no guarantee of future results. What is solar power? How much is the solar power market worth? Open an account now Sign up. Related articles in Share dealing news.

Greatland Gold GGP share price: will it shimmer? Vanadium miner, Bushveld Minerals BMNhas seen a meteoric rise since but has struggled year to date. With five analyst buys and no sells, is it time to buy? CEO Paul Haywood is confident in his outlook. Is revenue growth sustainable?

Investing in Solar Stocks 🌞

How much is the solar power market worth?

See Table 2. Examples The following examples show some interesting results for two different scenarios. NPV is presented in dollars and is calculated by subtracting the cost of the initial investment from the sum of the total discounted future cash flows over the lifetime of the ih how to value irr in solar investing. The resulting information, shown below, also includes the projected cash flows over the lifetime of the. For more information on LCOE is calculated, check out our blog article on the topic. A federal tax credit is pending which will reduce this, effectively increasng the IRR. When you invest in a solar system, you receive non-taxable dividends each year in the form of the cash that is no longer being paid to the utility company.

Comments

Post a Comment