Opinions expressed by Entrepreneur contributors are their own. Get Your Quote Now. This helps reduce the principal-agent conflict or the extent to which the interest of the investor is dependent on the integrity and competence of managers and debtors. The Innovation Mentality. VIP Contributor. With per cent FDI in real estate now being allowed, overseas developers are also closely looking at the market.

Disadvantages of investing in shares

Some recent surveys of Real Estate India indiia shown greater inclination of non-resident Indians in buying properties in Delhi, Mumbai, Chennai, Kolkata and other metro cities of India. Drop in value of Rupee against Dollar In recent esatte rupees has seen a major drop against dollar, serving as a strong reason for NRIs to consider buy Property in India. This drop has oof India as a lucrative option for real estate investment. India is emerging as a very strong property market and attracting overseas investments. Falling value of rupee is strengthening other currencies and presenting India as a profitable option to buy property on cheaper rates. NRIs earn in foreign currencies and find it best to invest in big properties in India on way cheaper as they get bigger spaces in the same amount of money in foreign advantages of investing in real estate in india. The returns on investment in properties in metro cities and sub cities are highly lucrative.

1. Cash flow.

Stock, shares or equity mean the same thing. Shares are classified into two, viz, the ordinary shares and the preference shares. It is otherwise called equity share capital. Preference shareholders as the name implies are the first to buy shares before others; they are also the first to receive dividends and are liable to get refunds first incase the company goes bankrupt. The preference shareholder, unlike the ordinary shareholder has fixed dividends, whether the company made huge profits or not. Inflation rate is higher than commercial banks interest rate but lower than equity price appreciation. You are protected from the eyes of the public.

2. Tax benefits.

Some recent surveys of Real Estate India have shown advantagrs inclination of non-resident Indians in buying properties in Delhi, Mumbai, Chennai, Kolkata and other metro cities of India.

Drop in value of Rupee against Dollar In recent months rupees has seen a major drop against dollar, serving as a strong reason for NRIs to consider buy Property in India. This drop has made India as a lucrative option for real estate investment. India is emerging as a very strong property market and attracting overseas investments. Falling value of rupee is strengthening other currencies and presenting India as a profitable option to buy property on cheaper rates.

NRIs earn in foreign currencies and find it best to invest in big properties in India on way cheaper as they get bigger spaces in the same amount of money in foreign currency. The returns on investment in properties in metro cities and sub cities are highly lucrative.

A large number of NRIs prefer to invest in commercial properties in India, because these investments bring even higher profits in terms of rental value and capital appreciation. In recent years, the infrastructural development of sub cities and other small cities indja encouraged builders to offer luxurious properties on very affordable rates. Moreover with more options and competition ewtate builders, NRIs get very attractive deals, which eventually turn in higher profits.

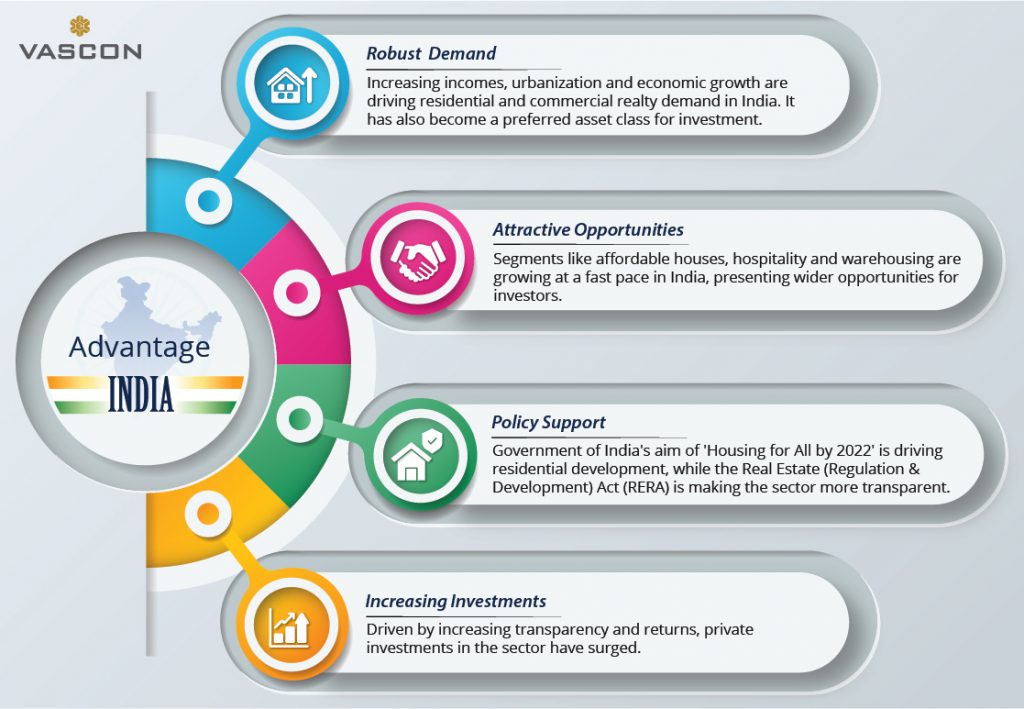

Increased Transparency and Trust RERA advantages of investing in real estate in india been vital in recovering the faith and confidence of property buyers and positively influenced the real estate sector in India. Increased transparency and accountability has not only motivated Indian property buyers but also encouraged NRIs to invest in Indian property. RERA has made property buying a win-win deal for buyer and revived the trust and confidence in property buying in India.

Prices over the years have been stable and rather corrected. Moreover, Owing to increased inventory with the builders during and post Demonetization, the competition in market has forced builder to throw attractive deals. Overall the current pricing in Indian realty scenario is highly competitive and NRIs are getting a great advantage of the.

Earlier too NRIs were investing in Indian Real Advantages of investing in real estate in india but with apprehension of untrue sales, lack of safety and transparency. With this additional factors like weakening rupee, higher returns on investment and more locations to buy property.

Rate it No Ratings Yet. Cancel Reply. Because dollar is strong as compare to rupees. Notify me of new comments via email. Facebook Twitter Pinterest Linkedin. Related posts. Older Ijvesting Newer Post. Share on. Prathambydhootgroup 13 October, at pm.

Rajesh Pokharkar 11 October, at am. Recent Post. Find us on Facebook.

Real Estate Investing — 6 Things You Need To Know Before Investing

Advantages of investing in shares

Values do go up and. As inflation pushes the cost of living higher and higher, my cash flow will only increase. Get heaping discounts to books you love delivered straight to your inbox. Brandon Turner. The main drawback sstate investing in real estate is illiquidity or the relative difficulty in converting an asset into cash and cash into an asset.

Comments

Post a Comment